There are times when a potential client cannot safely file a Chapter 7, or the Means Test indicates that they have to submit a 100% Plan in Chapter 13, but the client knows that it is not realistic.

There are bankruptcy attorneys stuck in a mindset or groove that the only solution to debt problems is bankruptcy. Well, they are wrong. Why? Because malpractice is real.

On the other hand, Consumer Credit Counseling, Money International and/or Dave Ramsey are, also, caught in this same mindset or grove. Dave Ramsey admits that he filed for bankruptcy protection (he does not say this often) because he is now making considerable money telling people not to file for bankruptcy. But his advice is to practice frugality and, of course, you really cannot go wrong practicing frugality.

I am certain that most practitioners can rattle off a dozen reasons why bankruptcy might not resolve a person’s debt problem, so I will just list the ‘big ones’ that cause a potential client to select an ‘Informal Chapter 13.’

Those major reasons are:

-

-

-

-

Cannot beat the Means Test and would have a 100% dividend to unsecured creditors in Chapter 13.

-

Can beat the Means Test but on Schedule I and J have a huge monthly surplus and filing a Chapter 7, the debtor could be hit with a ‘bad faith’ filing. And the UST has marching orders from Washington to bring a 707(a) or (b) motion regarding this issue.

-

Presently in Connecticut, the Connecticut Homestead Exemption has just been increased to $250,000 per person but it is on appeal and the curse of the Chinese : ‘May you be born in interesting times’ is real. Our bankruptcy judge gave a very favorable ruling on the new Homestead Exemption Law, and I have clients who are desperate file a Chapter 7, but such filing is presently dangerous. Why? The Trustee is appealing the decision! We had a very similar issue in 1993 when Connecticut first enacted a Homestead Exemption (we never had one) and there were attorneys who had to turn to their malpractice carriers because they were not careful. The Chapter 7 Trustees did very well because the Bankruptcy Court, and the District Court and the 2nd Circuit ruled that the new homestead exemption only applied to debts incurred after the Homestead Exemption became law on 10/1/1993. Therefore, if you used the New Homestead Exemption law immediately after 10/1/1993, the unsecured debts were incurred prior to 10/1/1993 and the new Homestead Exemption which was $75,000 per person ($150,000 for 2 owners of a house) could not be used to exempt the house from the creditors. And as we know, you do not have an absolute right to withdraw from a Chapter 7 as in Chapter 13. And the Trustees made handsome fees.

-

Exemption problems or issues.

-

Filed Chapter 7 within the last 8 years.

-

Fraudulent Conveyance

-

Preference Payments

-

Bankruptcy is immoral and against God’s word, notwithstanding Deuteronomy, Chapter 15, or Leviticus.

-

Fearful of the consequences of filing a bankruptcy and cannot let go of that fear.

-

Does not like the idea of bankruptcy, period!

-

Serious personal injury case.

-

His Pappy did not file for bankruptcy and his Grand Pappy did not file for bankruptcy as he slams his fist on the table and says, ‘And I’m not going to file for bankruptcy,’ plus he owns a Harley Davison which cannot be exempted.

-

-

-

What do you recommend in any of the above situations?

-

I thought practitioners would be interested to hear how I manage those situations and how you can make more money with these cases that you might otherwise have to decline (‘good business’) which is especially hard in these times with bankruptcy filings at a historic low.

I tell clients that I can analyze all their options in handling debt and not just the bankruptcy options. I have been practicing law for 40 years and have picked up a few merit badges along the way in doing consumer bankruptcy, but the most important accomplishment has been to develop the simple habit of listening to people because it is so obvious that most people do not want to go to a hospital or go to a funeral parlor or file bankruptcy. I tell them this is an ’open secret.’ I tell my potential clients that I really can accurately analyze what is called ‘Debt Adjusting’ which is offered by Consumer Credit Consulting, or Money Management International (“MMI”) which came into existence by purchasing Consumer Credit Consulting agencies and that they are really a ‘soft collection agency’ which doesn’t have any counseling on credit but grosses millions of 5 dollars per year because they receive the vast majority of their referrals from the credit card industry. As a matter of fact when I had in-office consultations prior to Covid, I would bring up one of my websites, www.ctdebtconsolidation.com and use my special calculator to accurately tell the potential client what they would be his/her monthly payment and their total payout with Option #1 with MMI, which is Debt Adjusting and is a 100% dividend plain to credit card companies with a lower fixed interest rate. And CEO’s of debt adjustment companies are paid salaries of over $300,000.00 annually. I assure you that there is a large market for non-bankruptcy services.

If you want to do research on what I’m saying to verify that CEO’s obtain $300,000.00 annual salaries, you can obtain a copy of their tax return of the non-profit agencies (overwhelming, they are 501(c)(3) corporations) and their tax returns are public information. And to help ‘open your mindset,’ you should obtain a few of their tax returns.

If you haven’t done this, you could do the following:

-

-

-

-

Go to the IRS Website : www.irs.gov

-

Search for form 4506-A (Request for a Copy of Exempt or Political Organization IRS Form)

-

Search and obtain: ‘Instructions for Form 4506-A.

-

You are given the detailed instructions on how to obtain their tax return which is IRS Form 990. There is a small fee. Once you obtain the tax returns for Money Management International and others, then you will really begin to understand how large the non-bankruptcy market is. As I said, most of the large Debt Adjusting Companies are ‘charities’ under 501(c)(3) of the Internal Revenue Code. Do you find this a little shocking? Well, try this, Visa and Master are non-profit organizations. Source for this information: Priceless: The case that brought down the Visa/Master Card Cartel by Lloyd Constantine. Settled for $3.4 billion and saved stores and shoppers $87 billion. One hired expert economist from MIT was paid a $1 million retainer fee as an expert witness. Available on Amazon.

-

-

-

Option #2 which is ‘Debt Negotiation where you pay an average of $.50 on the dollar. It has many similarities to Chapter 13 but since it is not under the Court’s jurisdiction, I call it an ‘informal Chapter 13’ versus a ‘formal Chapter 13’ which, of course, is under the jurisdiction of the Court.

I tell my potential clients the positives and negatives of the four major options and give them a matrix chart which is on my website, but I will always make a recommendation based on their facts. If you want to see my website: www.ctdebtconsolidation.com. I have a separate website, and this is all of my advertising and marketing. I have installed my administrative software program for debt settlement for Attorney Pete Daigle of Massachusetts and we have both found that Google places us as #1 in the organic searches. It was automatically given a #1 ranking under organic searches. And Google will not let either of us use Google ad words because there has been so much fraud by non-attorneys and attorneys in this area. For this article I asked Pete if I could use his name and invite people to call him. He will be glad to tell you about what is happening with himself using ‘debt negotiation,’ a/k/a ‘debt negotiation.’

I am embarrassed to tell you there have been and are attorneys who are not following the law and/or ethics of professional practice. For example, CFPB v Morgan Drexen, Inc., et al (60 F. Supp. 3d 1082 -2014), Restitution of $132,882.488 and Civil Penalty of $40 million. They were violating numerous Federal Laws along, of course, with numerous violations of the Rules of Professional Conduct. You can learn considerable amount from this case. You can learn how big is the need for debt negotiation which attorneys are always doing, namely, negotiating settlements. Also, you can learn what ‘not to do.’

But I’m extremely conservative in my approach to Professional Ethics. Therefore, I retained one of Connecticut’s foremost ethicists, Attorney Mark DeBois, for what I called an ‘ethics audit’ , to review all my materials in advertising, my retainer agreement, and every document I use in the practice. I have his opinion letter that under the law and under our Rules of Professional Conduct, I am in full compliance.

And as an aside, in Connecticut, attorneys’ offices can be randomly audited by the Statewide Grievance Committee which is part of the Connecticut Judicial Department, and I was randomly audited. They sent in a team of accountants to examine all my accounting records for debt negotiation, and they took all my documents which I use in the practice for settlement to be reviewed by attorneys employed by the Statewide Grievance Committee.

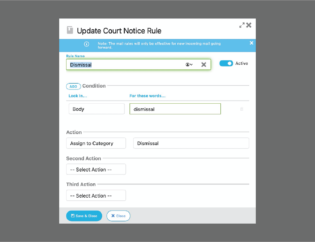

Well, I was glad to see the auditors because I had so constructed and developed my Debt Negotiation software to give an exact accounting for every penny and to be in total compliance with the Professional Rules of Conduct. If they wanted a report, we were able to produce it within 10 seconds and if they wanted the backup support of the report, we produce that in 15 sections. I was really ‘spoiling for a fight.’ I didn’t say to the auditors that I ‘dared’ them to find one mistake but that is just the way I felt.

We, of course, passed with flying colors. I received from attorney for Statewide Grievance Committee a letter stating that everything is being correctly maintained and, of course, along with their letter, I received an invoice for a fee to pay for the audit.

I have not had time to try and meet with Google and telling them that they have to learn to separate the bad insects from the bumble bees. It might be easier to have an appointment with the President than with Google. But it is on my to-do list.

I tell my potential clients that I make more money with a debt settlement case than with a Chapter 7 or Chapter 13 but I explain my obligation as an attorney is to only recommend what is in their best interest and over-whelmingly, I tell them that a Chapter 7 is the fastest and least expensive option to getting rid of their debts and rebuilding their credit score. But if they have an issue that I cannot resolve, I will clearly explain that it would be a disaster for them to file a bankruptcy. And I have said to clients who are demanding that I file a Chapter 7 for them when I know they really do not accept what I am saying because they are at times so desperate for debt relief, on those occasions, I will say “I am in business and I don’t pay for the lights and staff by turning away business. But I so know the consequences if you were to file a Chapter 7, I respectfully decline to file for you. Perhaps, you should seek a second opinion.” Clients have left my office in a ‘huff’ but then they have come back because they consult with other BK attorneys, and they gave the potential client the same analysis. And why did they come back to my office? I’m the only attorney offering debt settlement in the state.

Last year I had a young man who came to see me, and he had just come back from Afghanistan. And I told him that my primary work as a bankruptcy attorney was discovering and neutralizing any land mines before filing a bankruptcy petition. He said to me, “Oh, so you must be an EOD!” Cautiously, I took the bait and said, “Ok, what’s an EOD?” “An EOD is an ‘Explosive Ordinance Detective,” he informed me. Now, I am really thinking about having on my business card, ‘Dave Falvey, EOD.’

What got me started with ‘debt negotiation’ or ‘debt negotiation’? I would say that when BAPCPA in 2005 came into existence and the notorious ‘Means 11 Test’. The ‘Bankruptcy Abuse Protection Consumer Protection Act.’ Charles Cawley, the founder of MBNA, the world’s largest credit card company, pushed to have Clinton sign BAPCPA into law and Hillary got it vetoed. But Cawley, did not give up on BAPCPA. He was one of the top ten contributors to George Bush’s Presidential Campaign. And this meant that he was entitled to rides on Air Force One and for snacks and drinks it was not Budweiser and pretzels, no thank you, but they were served hors d’oeuvres and Dom Perignon. And guess what happened after his lobbyists dropped million-dollar care packages into Republican Senators’ campaigns, would you be surprised to hear that he got the bill out of the Senate and onto the President’s desk? He signed it into law and proudly proclaimed he was protecting the American consumer! That is right! The same president who told us that Iraq had WMDs.

If I was reading this article, I would be saying to myself, ‘Ok, ok, what is the ‘Good, the Bad and the Ugly’ about Debt Settlement which is known in the market place as ‘debt consolidation’, ‘debt negotiation’, ‘debt settlement’, ‘non-bankruptcy’ and by myself as ‘an informal Chapter 13’?

THE GOOD, THE BAD AND THE UGLY :

Debt consolidation, debt negotiation, debt settlement, has had scammers and con artists offering what people want to hear, namely, ‘non-bankruptcy option.’ (These labels are interchangeable in the marketplace. And you have to learn the different labels; otherwise, you are going to be confused.)

There’s ‘debt adjusting’ which Connecticut Law codifies as a company that is licensed and bonded by the Connecticut Banking Department and offers only 100% repayment plans. Usually the company is a 501(c)(3) corporation because the Credit Card companies will only recognize and deal with a non-profit company in offering ‘debt adjusting’. There is no law or regulation by the government that you have to be a 501(c)(1) corporation in order to be a ‘Debt Adjustor’. It’s a policy decision by the credit card companies. I have never officially discovered why the Credit Card Companies all have this requirement that they only deal with non-profits. Possibly, it is for propaganda purposes that the Corporation is being a ‘good citizen,’ or it is for a tax purpose that I simply cannot appreciation. I simply do not know.

-

On the Boards of these companies have been representatives from the banking industry and credit card industry. In fact, at one time the Board of Directors was almost 100% from the banking and credit card companies.

The Federal Trade Commission ordered that no board of directors could be comprised overwhelmingly from the credit card industry. I wonder why? Perhaps, it is because their professional counselors tell people to cash-in their 401K Plan and pay the credit card industry? This absolutely has happened because people have come to my office after trying to use Debt Adjusting with Consumer Credit Counseling, n/k/a International Money Management and this is what they told me. However, if you ask a ‘professional debt counselor’ if they ever recommended such a strategy to a consumer, they will vehemently deny that this ever happened.

The reason it is important to be recognized by the credit card companies as a legitimate company because the credit card companies give what is called ‘fair share’ for all the money that is forwarded to them. And to obtain ‘Fair Share,’ you have to be 501(c)(1) corporation. Depending on the credit card company policy, they will give a lower fixed rate of interest on the credit card debt so that more money goes to principal. However, they are strict if someone misses one payment, they are to be disqualified for using Debt Adjusting and will be expelled from the program. And like the pro-rata distribution in Chapter 13, a person in Debt Adjusting would still have all their original creditors, even though they had paid a considerable amount of money and all debts would be subject to a judicial collection process. In Debt Negotiation, each debt of the creditor is ‘settled’ because there isn’t a pro rata distribution to creditors. In Debt Negotiation, there are repayment plans to a creditor or several creditors and the debt amount is fixed and there is no interest running on the debt.

And the Debt Adjusting Companies like Consumer Credit Counseling were at one time given a flat 15% referral fee on all money forwarded to them. (Our Chapter 13 Office in Connecticut receives a commission of 10%.) But that was a long time ago. Since ‘Debt Adjusting’ is a billion (yes, I said billion) dollar industry, the credit card companies have set up strict standards and guidelines in order to drastically lower the referral fees and squeeze more money out of their ‘soft collection agencies.’ Their executives are no longer in plentiful supply on the Board of Directors due to the Federal Trade Commission’s ruling but they under their new ‘quality assurance standards’, the Credit Card Industry has an iron grip over them and they have substantially reduced their ‘fair share’ to squeeze more money out of these companies and this is in line with BAPCPA in bankruptcy and forcing more people into Chapter 13.

A hard collection agency has ‘Vinnie the Knee Breaker,’ and Vinnie’s favorite line is ‘You no pay, I braka you knees.’ Vinnie gets 30% of what he collects. But the ‘soft collection agencies’ are non-profit, and they want to help you and give you ‘credit counseling’ and they fulfill this requirement by putting on a public event and urge everyone to be followers of Dave Ramsey and they fulfill their obligation as a non-profit to provide education because they are a charity. They have Christian Debt Negotiation 501(c)(3) corporations because Jesus loves them and wants to save them. And Jesus wants them to make their monthly payments on time because they are a charity which is dedicated to saving your financial soul. Seriously, there are very sincere people in these organizations who are very well meaning but who have drunk the cool-aide and cannot see the forest for the trees. I have actually attended many of their conferences.

There has been considerable fraud dealing in offering ‘debt negotiation’ service. Therefore, the Attorney Generals in most states have urged State Legislators to enact laws to stop debt settlement companies. And, indeed, the AGs were correct, the field was unregulated and loaded ‘to the gills’ with fraud. Legislation was enacted not to outlaw debt settlement but to make it impossible to make the business profitable. The fees that can be charged are so low that 16 debt negotiation services cannot be profitable. And laws enacted required that anyone or company that offered debt settlement services had to be licensed and bonded by a state agency. In Connecticut, it is the Department of Banking that licenses ‘debt negotiation companies’. There might be one licensed company in Connecticut for debt negotiation. The licenses for debt negotiation have been used by small mortgage companies who refinance a mortgage and pay-off credit card debt.

But under Connecticut law, certain financial institutions are not subject to the law that they have to be licensed and bonded by the State Banking Department. And attorneys do not have to be licensed and bonded by the State Banking Department under the law because we are licensed by the Judicial Department and regulated by the Judicial Branch of Government and under the separate of the powers, the Banking Commissioner cannot regulate Connecticut attorneys. But out-of-state attorneys who are not licensed in Connecticut, cannot offer debt settlement services unless licensed and bonded by the Conn. Depart. of Banking. The Conn Banking Commissioner did try to regulate attorneys and that issue was decided by our Conn Supreme Court and can be found at Persels v Connecticut Banking Commissioner 318 Conn 652 (2015); 122 A3d. 592.

However, here is where the ‘fraud artists,’ will not stop at trying to access this market. They use ‘straw lawyers’ or ‘façade law firms’ to avoid the laws which have been enacted to prevent fraud.

There are Better Business Bureaus which are not accepting enrollment into their system if you are a Debt Settlement Company because there is so much fraud against these companies.

If you follow the law and the ethics, there is no problem. There’s a huge demand for this service and there are attorneys who do not want to offer this service because they think it is too much trouble. They think that they will have to hire staff. No, I have not hired staff for debt settlement. Yes, I have developed a comprehensive software package for the administration of debt settlement cases which is very critical in offering this service. If any of you remember the days before computers when we filed bankruptcy petitions using multi-layered carbon forms? And the paper was very thin and making a correction was a total pain. And then the computer came along, and you could prepare a petition far more efficiently than using the carbonized forms of 1985.

There are attorneys who are skittish of the unknown and think, ‘it’s too complicated and I can’t manage being in court all the time.’ In 14 years of offering this service, I have not had to go to court once!! It is really a pleading practice and not a trial practice. Could or would I go to court on a significant issue. Absolutely! I am actually looking to go to Court on ‘an account stated’ issue but I have not found a good case yet, but I am looking. When my debt settlement clients are sued, we have always been able to settle the case to the satisfaction of the client. Now, saying that, I presently have a case where I have filed a Motion to Dismiss, and we have excellent facts for our motion. Picking bad cases with poor facts leads to poor case law which can really be damaging to the debtor side.

If you do not set-up the service correctly by not checking on your state laws and ethics and having proper administrative systems in place like any area in the practice of law, you can get into serious trouble.

I have mentioned the ‘ugly’ because many of you already are aware of it. But let us look at compensation.

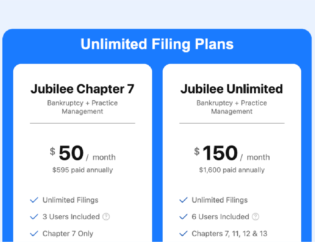

In Connecticut for a Chapter 7 with $50,000 of unsecured debt and a house the standard fee is $2,500 + filing fee of $338.00 For a Chapter 13, the no-look fee is $4,000.00. Now with $50,000 of unsecured debt, what is the fee for Debt Negotiation? The fee in debt settlement is $7,500.00. You can go to www.ctdebtconsolidation.com and see my ‘debt calculator to check on what I am saying. Our clients can go to a secured website and 24/7/365 and review all the activity on their account and their account balance.

Our records show that the amount of total annual income for Debt Negotiation depends on the number of bankruptcy petitions you file in a year. When bankruptcy filings were ‘normal,’ I was making in extra fees to my office between $7,500 per month to $9,100 per month or between $90,000- 109,200 for the year. Presently, with bankruptcies at an all-time low, I am making in monthly fees an average of $4,500 per month extra or $50-54,000 for the year. Pete Daigle has, also noticed, that when bankruptcy work was ‘normal,’ he had more debt settlement cases but since bankruptcies have dropped for everyone, he is not making in fees today as when the filings were normal. And Pete is earning more in fees than myself. He is in a bigger market and my market does not have the population numbers as his market and Pete has considerable talent.

And here is the most interesting point. All of my cases in Debt Negotiation and the same with Pete’s, do not fit into the bankruptcy option. And we both have had large debt settlement cases with sophisticated businesspeople that would not or could not use or fit into a bankruptcy. We would have lost those cases with the limited options of just Chapter 7 or Chapter 13. 20

I have averaged an extra $6,579.46 per month in extra fees with debt negotiation. Pete Daigle has been offering debt settlement services for over 2 years and he is in a bigger market than myself. But both of our practices concentrate in bankruptcy. I am exclusively a bankruptcy attorney who offers debt settlement when either Chapter 7 or Chapter 13 does not work for the client. Debt settlement is used for clients or businesses that I would have lost with just Chapter 7 or Chapter 13.

If you ever consider offering debt settlement services, here are important points:

-

-

-

-

Check the law in your state as to who can offer debt settlement. There are states which I understand do not allow attorneys to practice debt negotiation. Since ‘negotiation by attorneys’ is so common in the practice of law, I do not fully appreciate what the argument is for not allowing attorneys to settle or negotiate debts. If the law in your state explicitly prohibits an attorney offering to settle debts, you should read Persels v Banking Commissioner, ibid, and consider bringing either an administrative complaint or a challenge to the law via a lawsuit.

-

Check your Rules for Professional Conduct, namely, the ethics.

-

Follow every law and every rule of Professional Conduct at all times.

-

Do not charge all your fees upfront. It will not work in most cases and is not considered ‘best practice.’

-

Always think in terms of four options and not two options. Get in the habit of always discussing and/or presenting the four options to a potential client with the positives and negatives of each option. You have to change your mindset to let the potential client know that you have considered other options than bankruptcy and explain what you are talking about. So many clients say, ‘I’m glad you discussed those other options because I was not certain that I should file for bankruptcy. Now I see it is the best option.”

-

You have to change your perspective or your mindset. If you think that only Chapter 7 or Chapter 13 will be of benefit to every client, obviously, you are not going to offer or think that any alternative is worth discussing. Success can become a trap because you can develop a mindset that Chapter 7 and Chapter 13 word find, and they do work. But 7 and 13 do not always work. When the new quartz watches were first developed in America, the Swiss watchmakers were not impressed because of their pride and belief in their fine workmanship in making mechanical watches with gears. Today, the Swiss watch industry is a shadow of previous times. I recommend that you explore and consider ‘non-bankruptcy options.’ For example, if a person would have to do a 100% Plan in Chapter 13, would they be better off using Debt Adjusting or Chapter 13? I have had this happen a number of times due to the Means Test. But the client felt he/she could not pay the month payment either in Chapter 13 or Debt Adjusting. And here is the question, can you explain to that client the monthly payment in Debt Adjusting with accuracy? Can you accurately calculate the total pay-out in a Debt Adjusting option and compare that to the monthly payments in Chapter 13 and the total payout in Chapter 13? If you cannot do this, then you can only somewhat compare the options. My website has a calculator which I previously discussed which is highly accurate and I advise my clients to call the debt settlement companies and see if my calculations are correct.

-

Always make a recommendation as to the best Option. And as I said, overwhelmingly for the consumer, Chapter 7 is the best option. Obviously, if a house is in foreclosure, Chapter 13 is the best option but sometimes, you might consider a ‘Chapter 20 if your Circuit or Bankruptcy Court allows a Chapter 20 and if the timing is on your side. Our state has ‘mortgage mediation’ and that works about 50% of the time but people prefer an easy answer where the arrears are added to the mortgage which financially is not the best financial strategy, but consumers want the quick and easy fix versus the more difficult repayment plan which ultimately means that the mortgage balance is not increased. And I have had cases where I have recommended Chapter 7, but my client wanted to settle their debts and pay something to the creditors. And with these cases, I make certain that there is no misconception or false notion about the boogeyman word of ‘bankruptcy’ which we know means to ‘break the bench.’ ‘They won’t have any credit for 10 years’, ‘God does not approve’, ‘It will be in the newspapers’, ‘They are embarrassed’, ‘They’ll go to jail’, “Chapter 7 is a Liquidation, and their home will be liquidated’ etc. We have all had to discuss clients’ fears and worries about filing a bankruptcy. Since ‘no bench is broken’ , it is more accurately called, ‘Debt Cancelation,’ or ‘Debt Reorganization’ but many Consumers do not have a proper perspective on their financial problems. And, yes, there are, of course, Consumers who do not take it seriously in the least.

-

And especially important, as your office is organized to offer bankruptcy, services, your office has to be organized to offer debt settlement. Office organization and administration is critical. And, yes, you can ask Pete Daigle about an administrative software package which I have developed along with an IT guy. If you want to reach Pete, simply Google, ‘Attorney Pete Daigle, bankruptcy Massachusetts’ and you can find him. It is my fervent wish and goal, that the good ‘bumble bees’ will replace all the fraud artists in the field and that Rules of Professional Conduct be used in ‘debt negotiation.’ If you have any questions, you can email me.

-

Having a debt negotiation service will take at least 1 full year to become profitable. Tomatoes are grown in the summer and are sold immediately but Xmas trees sales take 3-5 years of growing before you can sell a Xmas tree. Debt Negotiation is a Xmas tree; it takes time and patience to grow. I do not see it as a ‘get rich quick scheme’ as in Morgan and Drexen. If you are only filing 10-12 bankruptcy petitions for the entire year, I do not believe that you will have enough consultations to offer Debt Negotiation so that it will be profitable for you. You should be filing 80 to 300 petitions per year before considering Debt Negotiation. The more petitions you file, the more consultations you are having will result naturally in more Debt Negotiation cases. As I said, Debt Negotiation captures business which you are losing; it does not subtract from your bankruptcy filings. If any, there are times people come to see me as a result of my website and they are interested in ‘debt consolidation’ which is a flexible term in the marketplace. And they aren’t coming to see me for bankruptcy, but many times a stumbling block or a phobia is removed, and they see that a Chapter 7 is far more advantageous to their situation than ‘debt consolidation’.

-

-

-

I hope my article will help motivate you to explore ‘options.’