January 2023 | Newsletter

Attention BKPRO Users – It’s time to start moving to Jubilee

BankruptcyPRO has been around for over two decades; it’s not surprising that many users don’t want to leave it for anything else. But, BKPRO has been strictly in maintenance mode for the past year, and it will not go on forever. We’ve had a steady stream of users moving over to Jubilee and, with our conversion routines, FlashDOCS compatibility, and free training – it’s never been easier to convert.

Starting with March renewals of this year, we will be reflecting the cost of maintaining BKPRO with gradual price increases. Without any doubt, Jubilee will be the less expensive option going forward. Jubilee has been online since 2016. It was the very first online bankruptcy platform and larger companies like Stretto are still trying to catch up with us. We are proud to say that Jubilee is, without a doubt, the best bankruptcy software available – and it also happens to be the least expensive thanks to our low overhead.

When you’re ready to start making the transition, just contact our support staff and they will give you directions on preparing your office to make the move. We understand change if difficult, but our support staff is here to help you though the transition and we believe you will be glad you made the switch.

Introducing Student Debt Solutions

In January 2023, Jubilee is pleased to announce an integration with Student Debt Solutions™ (SDS) from Resolvent, LLC. SDS provides a unique self-service application for bankruptcy clients with student loan debt. Your clients will be able to determine their best options for reducing monthly or total debt payments by identifying the best federal programs that meet their financial goals. This is the first solution designed for attorneys to offer their clients without the need for the attorney to become an expert in student loan debt resolution.

About one third all bankruptcy clients have student loan debt but solutions for those debt payments have been elusive without expensive counseling or their attorney becoming knowledgeable with student debt resolution solutions.

Based on years of experience with over 25,000 consumers, SDS has put the counseling/interview process into software where your clients can determine the best repayment program on their own. They can also use the document preparation tools to prepare the required documents and even schedule a counselor if that is needed. All these student loan services are offered without the attorney’s involvement resulting in a no-risk opportunity for the attorney to assist bankruptcy clients identifying solutions to reduce their student loan debt.

Whether the analysis is done before the bankruptcy filing or after the discharge, SDS allows the bankruptcy attorney to help their clients resolve the remaining debt items while enjoying a revenue share for their efforts to introduce the application.

For more information and a demonstration of the application, click here.

Email Integration Into Jubilee

A common request has been to have Jubilee integrate with your email provider and keep client emails grouped by case. Having all your communications, both text and email, all organized within a Jubilee case would be a great convenience to have. We’ve been working on this very concept as a side project, and we are close to being able to beta test it.

The biggest issue, however, is going to be price. There is a cost associated with the third-party service provider that we are using, and this cost will have to be passed on to those who choose to use the service.

If you are interested in this type of service, please take a couple minutes to take our survey so we can determine what the true demand is. If you have no interest in an email integration feature, then we’d like to hear that too (just answer the first question)!

We look forward to your feedback!

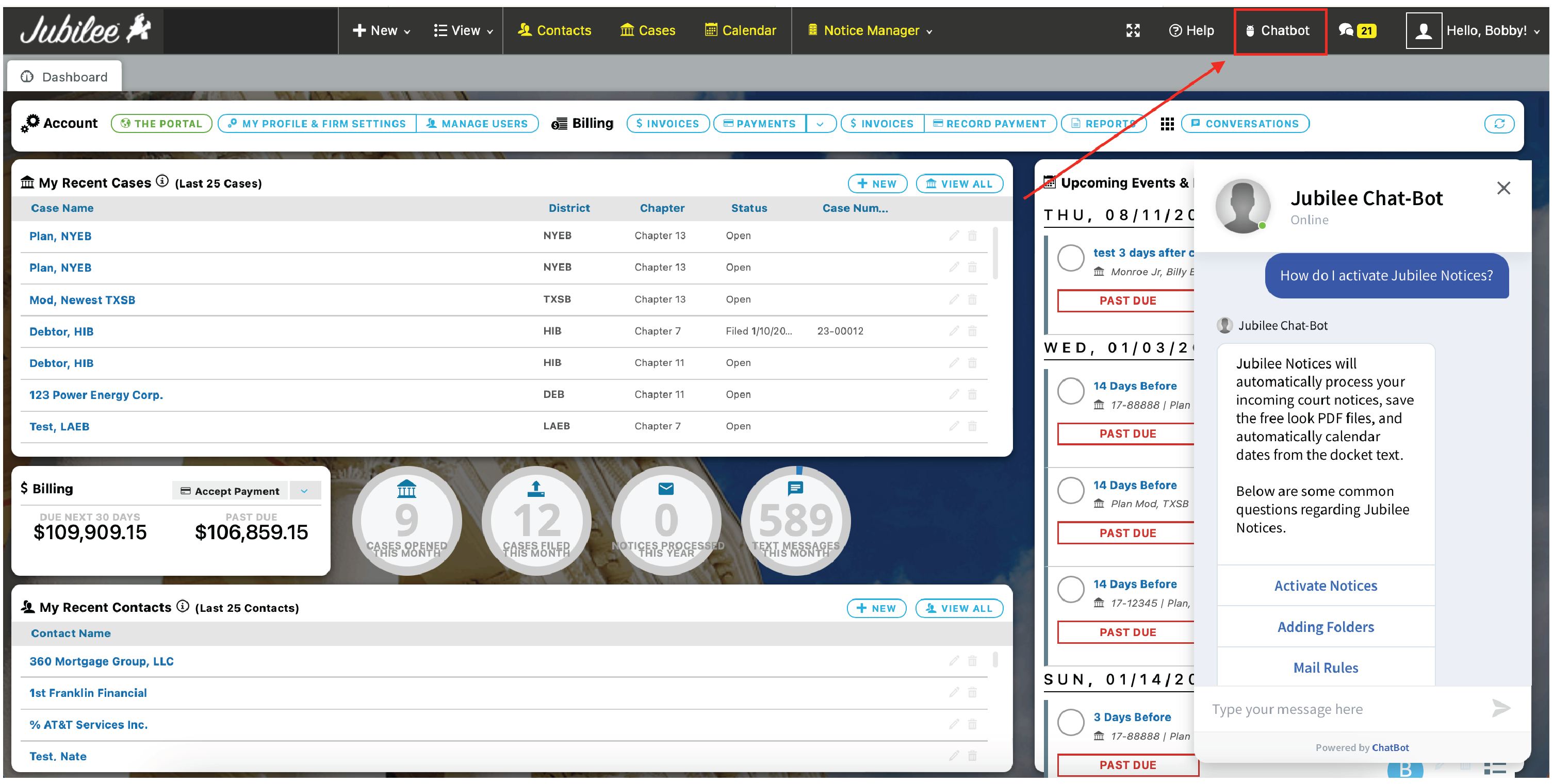

Try Out Our New Chat-Bot

We have a new chat bot that we think many of you will appreciate. It is loaded with hundreds of topics and is very good at finding answer to various questions to type in. It can be opened from the top tool bar and then hidden so it doesn’t get in the way. As it gets used, we will discover what questions are being asked that don’t have answers and add those to the database for future users – so it will keep getting smarter. So call us, email us, submit a support ticket, or try the chat bot – there are now more ways to get support that fit your needs.

Using Jubilee Mail Rules

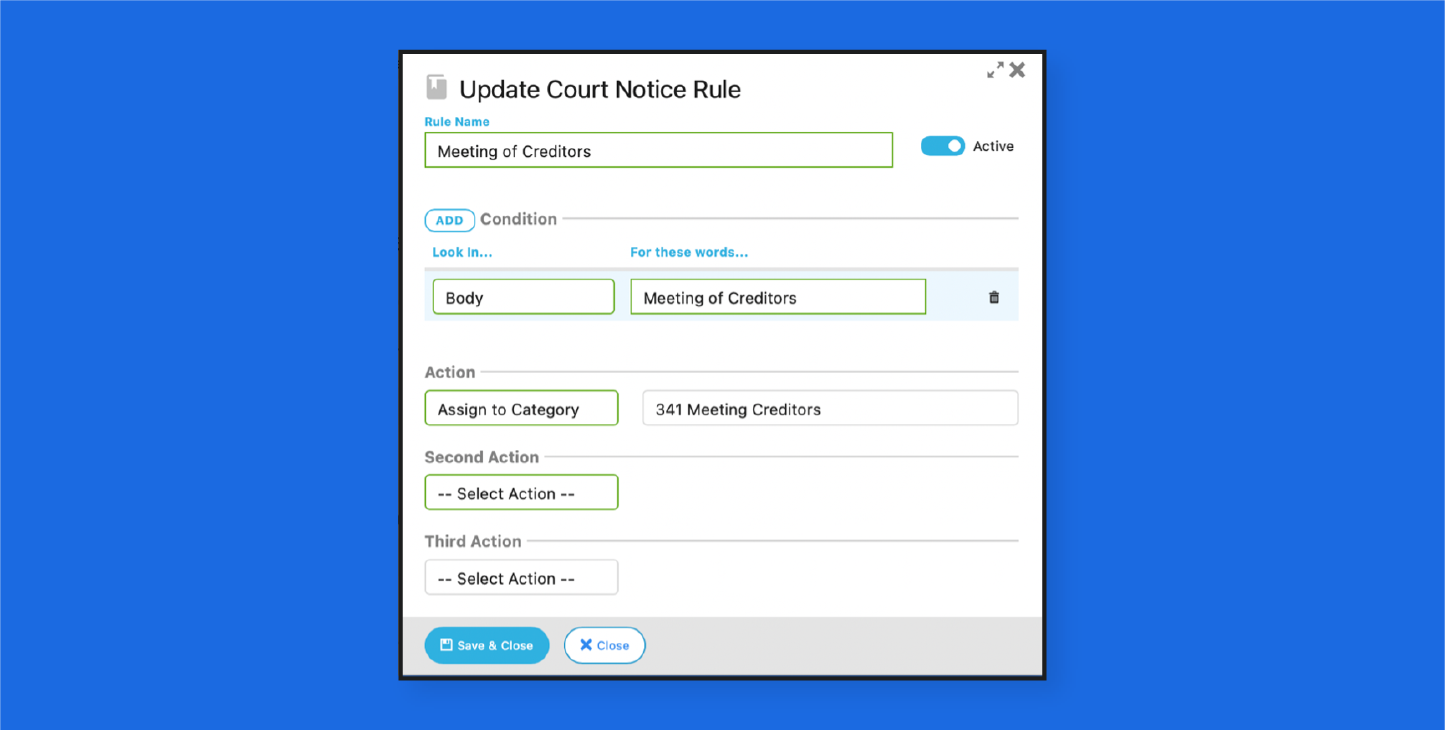

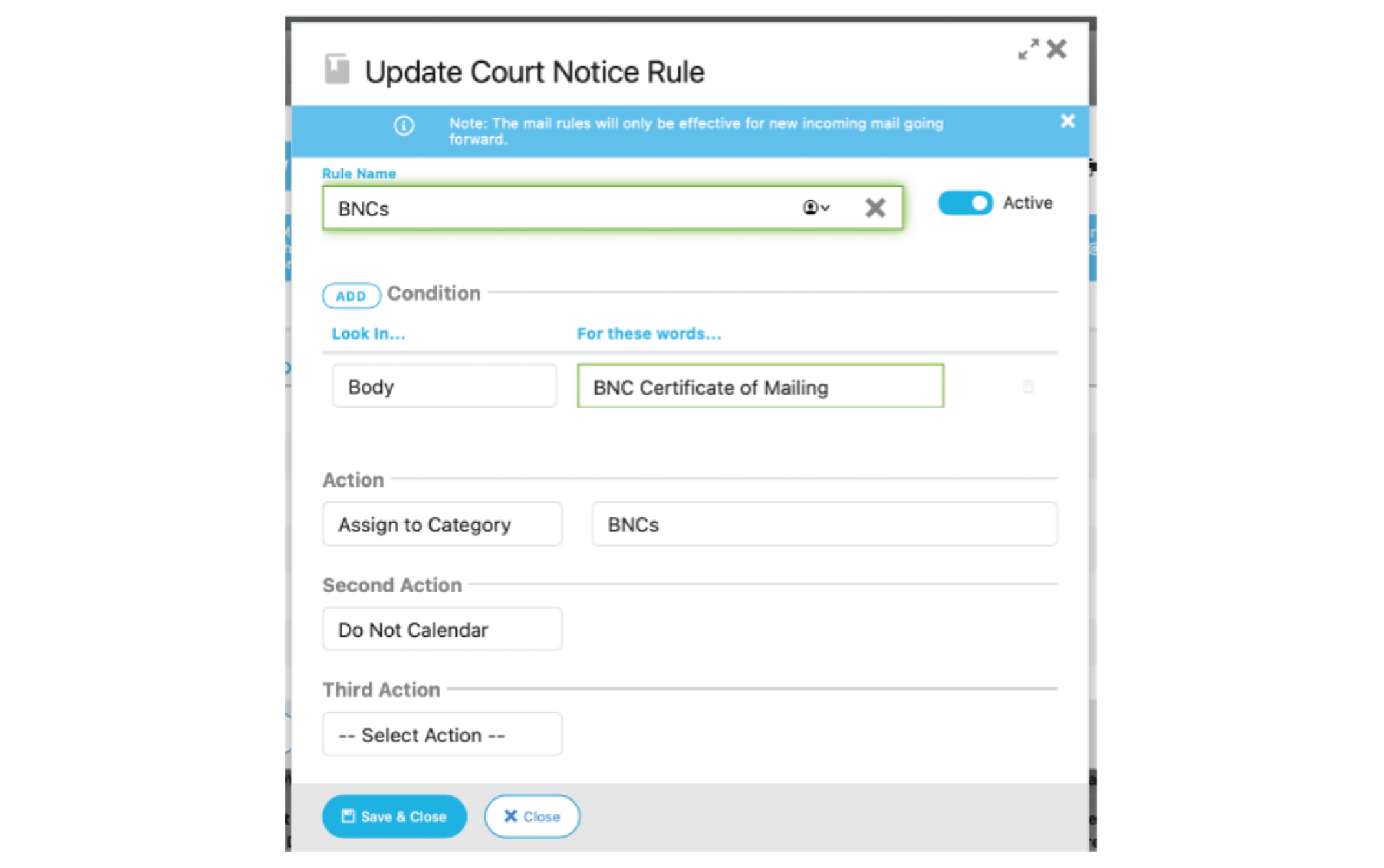

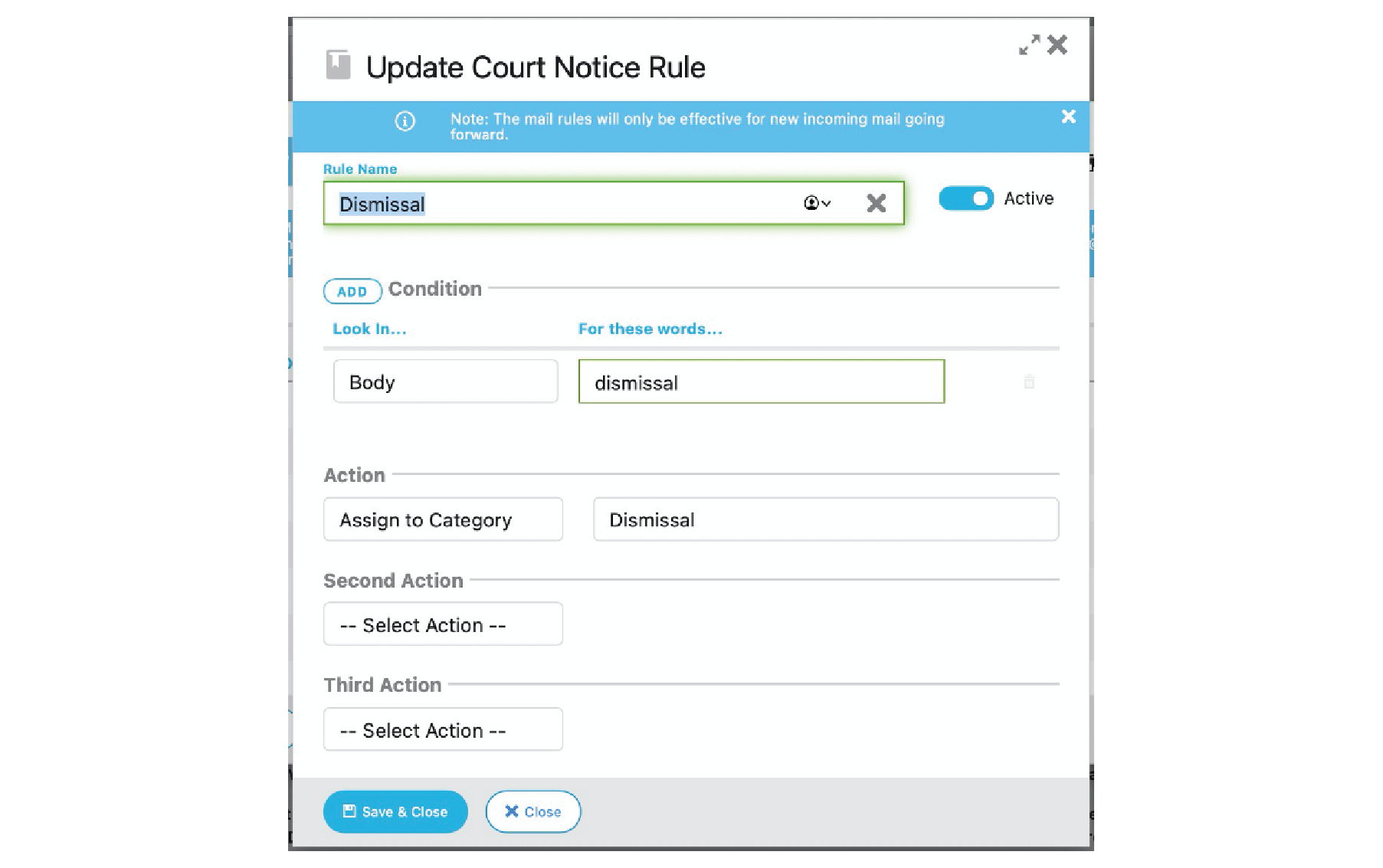

Here are two examples we have seen used:

- Move "BNC Certificate of Mailing" to the BNC Folder

- Move notices that contain the word "dismissal" to the Dismissal folder

You would first need to create the folders/categories by going toSettings - Profile & Firm Settings - Firm Defined Lists - then add the categories (BNCs & Dismissal) in the Court Notices: Categoriessection. Also, you may need to adjust your rules slightly as these "keywords" are not exactly the same in every Jurisdiction.

1. This rule will search the body of the court notice for "BNC Certificate of Mailing" then move it to the BNCs folder and exclude any of the dates in these emails from being added to the Jubilee.

2. This rule will search the body of the court notice for "dismissal" then move it to the Dismissal.

In The News

Department of Justice’s New Process for Student Loan Bankruptcy Discharge Cases

Each year, individuals in the bankruptcy process seek to discharge student loan debt in order to get the “fresh start” envisioned by the bankruptcy code. Congress has set a higher bar for discharging student loan debt compared to other debt—debtors who seek to discharge student loans must prove in a separate “adversary proceeding” that paying their student loans would impose an “undue hardship.” But that higher bar need not be an insurmountable barrier for debtors who cannot afford to pay their student loans.

The Department of Justice, in close coordination with the Department of Education, is implementing a new process at the outset of adversary proceedings in which debtors seek to discharge federal student loans in bankruptcy. While the bankruptcy judge makes the final decision whether to grant a discharge, the Justice Department can play an important role in that decision by supporting discharge in appropriate cases. The new process will help ensure transparent and consistent expectations for the discharge of student loan debt in bankruptcy; reduce the burden on debtors of pursuing such proceedings; and make it easier for Justice Department attorneys to identify cases where discharge is appropriate.

Under the Justice Department’s new process, debtors will complete an attestation form to assist the government in assessing the discharge request. The Justice Department, in consultation with the Department of Education, will review the information provided, apply the factors that courts consider relevant to the undue-hardship inquiry, and determine whether to recommend discharge. Even where the applicable factors may not support a complete discharge, where appropriate, the Justice Department will consider supporting a partial discharge.

Justice Department attorneys will assess the undue-hardship factors in the following manner:

Present Ability to Pay – Using existing standards developed by the IRS and the information provided by the debtor, the Justice Department attorney will calculate a debtor’s expenses and compare those expenses to the debtor’s income. If a debtor’s expenses equal or exceed the debtor’s income, the Department will determine that the debtor lacks a present ability to pay.

Future Ability to Pay – The Department will then assess whether the debtor’s present inability to pay is likely to persist in the future. The Department attorney will presume a debtor’s financial circumstances are not likely to change if certain factors—such as retirement age, disability or chronic injury, protracted unemployment history, lack of degree, or extended repayment status—are present. Where such factors are not present, the Department attorney will assess the facts showing whether the debtor’s present inability to pay is likely to persist.

Good Faith Efforts – In assessing what courts call the “good faith” standard, the Department will focus on objective criteria reflecting the debtor’s reasonable efforts to earn income, manage expenses, and repay their loan. The Department attorney will consider, for example, whether the debtor contacted the

Department of Education or their loan servicer regarding payment options for their loan. A debtor will not be disqualified based on past non-payment if other evidence of good faith exists. A debtor also will not be disqualified based on their not enrolling in an income driven repayment plan where the debtor was deterred from participating in such a plan or otherwise provides a reasonable explanation for non-enrollment.

For the complete details on the criteria and methodology the DOJ uses to make their recommendation, download the document from this link: https://www.justice.gov/civil/page/file/1552681/download

The attestation form can be found here: https://www.justice.gov/civil/page/file/1552666/download

How to understand if filing the attestation form is warranted:

Diligence with a bankruptcy client should uncover the financial details of that client’s situation. However, the key criteria for assessing undue hardship can be elusive. Using a software solution like Student Debt Solutions will help you understand the debtor’s current student loan situation and determine if there is a better payment plan available through government programs or if they have applied for these programs in the past. With this useful information, you can have confidence submitting the attestation with knowledge of their efforts related to good faith and that there are no lower payment options for the student loan debtor and they are still unable to pay and likely to be able to pay in the future.

Content contributed by Melissa Maguire

Melissa Maguire is a principal of Resolvent. She is a student debt expert with over a decade of certification and experience in the student debt market. She has been a key contributor in the development and expertise of Student Debt Solutions.

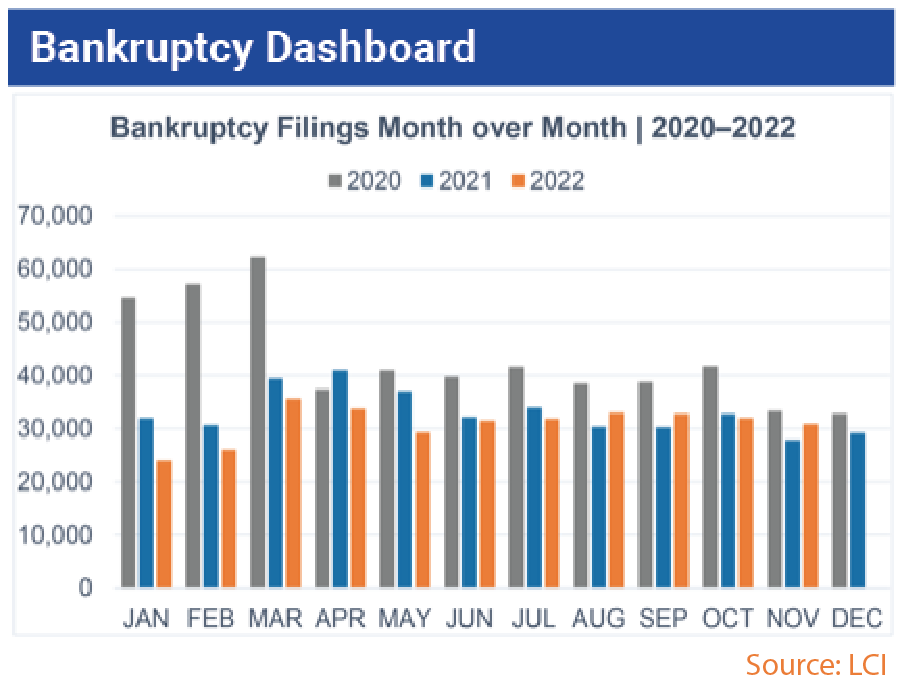

November Bankruptcy Filings

Jubilee Updates

- CACB - Added automatic filing support for case completions

- COB - Added automatic filing support for case completions

- MDB - Added automatic filing support for Fee Waiver

- NJB - Added automatic filing support for case completions

- NMB - Added filing support for Certification/Statement Regarding Martial Status